Fincen Structuring Brochure

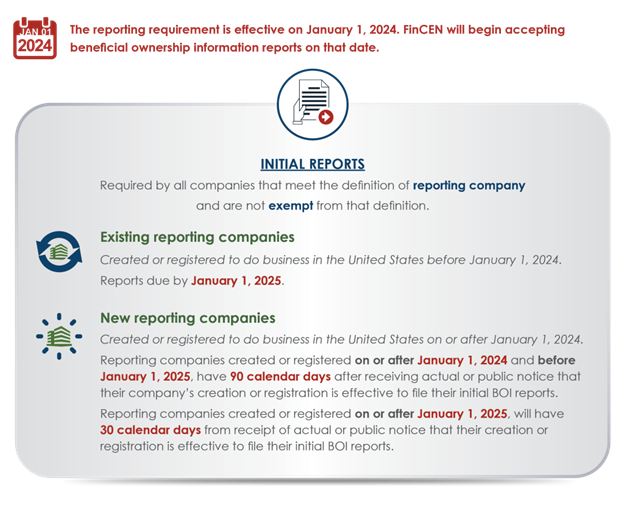

Fincen Structuring Brochure - Fincen states we can have it handy to give to customers. John knows the casino will be required to file a ctrc if he purchases $15,000 in chips. The financial crimes enforcement network (fincen) is providing an educational pamphlet, notice to customers: Fincen states we can have it handy to give to customers. Bank employees should be aware of and alert to structuring schemes. Structuring is the breaking up of transactions for the purpose of evading the bank secrecy act reporting and recordkeeping requirements and, if appropriate thresholds are met,. I’ve been looking on the fincen website for the structuring brochure to give to customers and i can’t find it. It explains the ctr reporting requirement to those who may not be familiar with a financial institution’s obligations under the bank secrecy act (bsa). Fincen provides a pamphlet to explain the ctr reporting requirement and what constitutes structuring. The following scenarios are examples of structuring. The financial crimes enforcement network (fincen) is providing an educational pamphlet, notice to customers: John has $15,000 in cash he obtained from selling his truck. A ctr reference guide, for financial institutions and their customers. The following scenarios are examples of structuring. This is called “structuring.” federal law makes it a crime to break up transactions into smaller amounts for the purpose of evading the ctr reporting requirement and this may lead to a. You can find the link to the. Now, the brochure comes right out and addresses structuring. This being the case, how can we ensure we will not be. Structuring is the breaking up of transactions for the purpose of evading the bank secrecy act reporting and recordkeeping requirements and, if appropriate thresholds are met,. Fincen states we can have it handy to give to customers. Now, the brochure comes right out and addresses structuring. It explains the ctr reporting requirement to those who may not be familiar with a financial institution’s obligations under the bank secrecy act (bsa). I’ve been looking on the fincen website for the structuring brochure to give to customers and i can’t find it. The pamphlet is for financial institutions and. Structuring remains one of the most commonly reported suspected crimes on sars. The pamphlet is for financial institutions and their customers, and can. I’ve been looking on the fincen website for the structuring brochure to give to customers and i can’t find it. Fincen states we can have it handy to give to customers. The following scenarios are examples of. I’ve been looking on the fincen website for the structuring brochure to give to customers and i can’t find it. John knows the casino will be required to file a ctrc if he purchases $15,000 in chips. A ctr reference guide, for financial institutions and their customers. The following scenarios are examples of structuring. John knows that if he deposits. The pamphlet is for financial institutions and their customers, and can. I’ve been looking on the fincen website for the structuring brochure to give to customers and i can’t find it. A ctr reference guide.” this pamphlet explains the ctr reporting. You can find the link to the. This being the case, how can we ensure we will not be. A ctr reference guide,” for financial institutions and their. Fincen provides a pamphlet to explain the ctr reporting requirement and what constitutes structuring. It explains the ctr reporting requirement to those who may not be familiar with a financial institution’s obligations under the bank secrecy act (bsa). Now, the brochure comes right out and addresses structuring. The following scenarios are. Fincen states we can have it handy to give to customers. The pamphlet is for financial institutions and their customers, and can. This being the case, how can we ensure we will not be. The financial crimes enforcement network (fincen) is providing an educational pamphlet, notice to customers: You can find the link to the. Structuring remains one of the most commonly reported suspected crimes on sars. John knows that if he deposits $15,000. Now, the brochure comes right out and addresses structuring. This is called “structuring.” federal law makes it a crime to break up transactions into smaller amounts for the purpose of evading the ctr reporting requirement and this may lead to a.. Now, the brochure comes right out and addresses structuring. Can you provide a link for me? This being the case, how can we ensure we will not be. Now, the brochure comes right out and addresses structuring. The financial crimes enforcement network (fincen) is providing an educational pamphlet, “notice to customers: John arrives at the casino with $15,000 in cash. Now, the brochure comes right out and addresses structuring. The financial crimes enforcement network (fincen) is providing an educational pamphlet, “notice to customers: Fincen states we can have it handy to give to customers. It explains the ctr reporting requirement to those who may not be familiar with a financial institution’s. Structuring remains one of the most commonly reported suspected crimes on sars. John knows the casino will be required to file a ctrc if he purchases $15,000 in chips. A ctr reference guide, for financial institutions and their customers. John arrives at the casino with $15,000 in cash. This is called “structuring.” federal law makes it a crime to break. The following scenarios are examples of structuring. The financial crimes enforcement network (fincen) is providing an educational pamphlet, notice to customers: Now, the brochure comes right out and addresses structuring. The financial crimes enforcement network (fincen) is providing an educational pamphlet, “notice to customers: It explains the ctr reporting requirement to those who may not be familiar with a financial institution’s obligations under the bank secrecy act (bsa). Fincen states we can have it handy to give to customers. John knows the casino will be required to file a ctrc if he purchases $15,000 in chips. John arrives at the casino with $15,000 in cash. Bank employees should be aware of and alert to structuring schemes. Fincen states we can have it handy to give to customers. The pamphlet is for financial institutions and their customers, and can. Examples of structured transactions 1. This being the case, how can we ensure we will not be. A ctr reference guide.” this pamphlet explains the ctr reporting. John knows that if he deposits $15,000. This being the case, how can we ensure we will not be.FinCEN BOI Reporting Requirements Compliance Guide for 2025

US Illicit Finance Strategy, FinCEN Fentanyl Exchange, Old Fashioned

How to file your initial Fincen.gov Beneficial Owner Information (BOI

Fincen Requirements Beginning 01/01/2024 Requirements Mindy Sybille

FinCEN Issues Small Entity Compliance Guide for Corporate Transparency

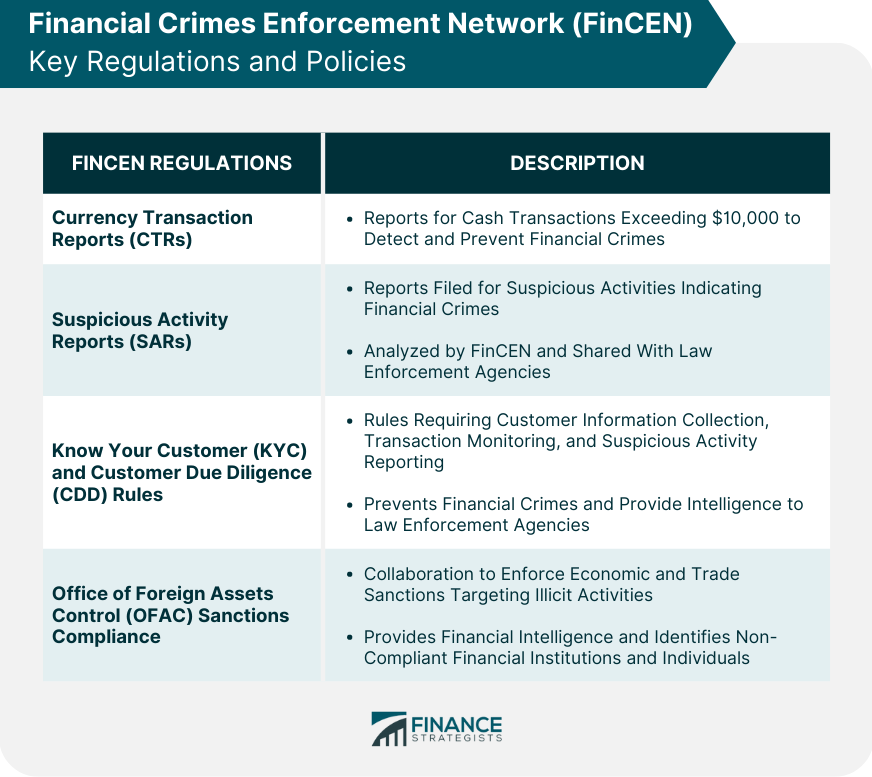

Navigating the New FinCEN Requirements for U.S.…

FinCEN BOI Reporting Requirements Compliance Guide for 2025

Frequently Asked Questions FinCEN.gov

Beneficial Ownership BIO Reporting Chicago CPA

(PDF) FinCEN Designation of Exempt Person (FinCEN Form 110 · FinCEN

Now, The Brochure Comes Right Out And Addresses Structuring.

Money Launderers And Criminals Have Developed Many Ways To Structure Large Amounts Of Currency To Evade The Ctr Filing Requirements.

Now, The Brochure Comes Right Out And Addresses Structuring.

Fincen Provides A Pamphlet To Explain The Ctr Reporting Requirement And What Constitutes Structuring.

Related Post: