American Funds Simple Ira Brochure

American Funds Simple Ira Brochure - When you set up your simple ira account, you have the opportunity to invest in the american funds, a family of mutual funds that has been helping people like you meet their savings goals. Learn about the benefits, eligibility, pricing and plan administration. Compare the benefits and key features of simple ira and simple ira plus plans to determine which option is best for your client. Digital investing programretirement calculatorfund comparison toolinvestment tools Review the understand your simple ira options brochure. Review the understand your simple ira options brochure. With the premiere select simple ira plan, you can reduce your current income taxes. It defines the provisions of the american funds ira. To learn more about setting up a self directed simple ira and exploring its benefits, visit american ira. Trusted by millionssee our comparison table2020's 5 bestus dealers Review the understand your simple ira options brochure. Learn about the benefits, eligibility, pricing and plan administration. Offer lower costseasy plan designimmediate vestingtax benefits Learn about fees, eligibility, funding guidelines and more when opening an american funds simple ira. Simple ira retirement plans are like 401(k) plans but designed for small businesses. Our team of experts is here to guide you through every step of the process,. Digital investing programretirement calculatorfund comparison toolinvestment tools Now it is easier for you to keep that focus because your employer has started an mfs® simple ira plan. Complete the two required forms in this booklet — the online group investments (ogi) contributions agreement and the adoption. Compare the benefits and key features of simple ira and simple ira plus plans to determine which option is best for your client. Help clients figure out which iras they’re eligible for, using a detailed chart; Go over the pros and cons of each type of ira; An ira participant is allowed only one rollover from one ira to another (or the same ira) across all iras (traditional, rollover, roth,. Explain the ira conversion opportunity ;. Compare the benefits and key features of. To learn more about setting up a self directed simple ira and exploring its benefits, visit american ira. Trusted by millionssee our comparison table2020's 5 bestus dealers This document should be read prior to opening the account. Offer lower costseasy plan designimmediate vestingtax benefits With the premiere select simple ira plan, you can reduce your current income taxes. The simple ira plan — the savings incentive match plan for employees of small. To open your simple ira, complete the application and sign in section 7. Review the understand your simple ira options brochure. Explain the ira conversion opportunity ;. To learn more about setting up a self directed simple ira and exploring its benefits, visit american ira. An american funds simple ira, your employees can participate in a quality retirement plan that’s similar to a 401(k) but designed especially for small businesses. Learn about fees, eligibility, funding guidelines and more when opening an american funds simple ira. Offer lower costseasy plan designimmediate vestingtax benefits Compare the benefits and key features of simple ira and simple ira plus. Now it is easier for you to keep that focus because your employer has started an mfs® simple ira plan. Compare the benefits and key features of simple ira and simple ira plus plans to determine which option is best for your client. American funds simple ira to establish your plan 1. Compare the benefits and key features of simple. With the premiere select simple ira plan, you can reduce your current income taxes. This document should be read prior to opening the account. Help clients figure out which iras they’re eligible for, using a detailed chart; Now it is easier for you to keep that focus because your employer has started an mfs® simple ira plan. This brochure is. Learn about the benefits, eligibility, pricing and plan administration. Offer lower costseasy plan designimmediate vestingtax benefits The amount you contribute to your simple ira is deducted from your salary before most federal. Our team of experts is here to guide you through every step of the process,. This brochure is designed to help financial professionals and retirement plan sponsors understand. Go over the pros and cons of each type of ira; Review the understand your simple ira options brochure. An american funds simple ira, your employees can participate in a quality retirement plan that’s similar to a 401(k) but designed especially for small businesses. Trusted by millionssee our comparison table2020's 5 bestus dealers Digital investing programretirement calculatorfund comparison toolinvestment tools With the premiere select simple ira plan, you can reduce your current income taxes. To learn more about setting up a self directed simple ira and exploring its benefits, visit american ira. Trusted by millionssee our comparison table2020's 5 bestus dealers Digital investing programretirement calculatorfund comparison toolinvestment tools To open your simple ira, complete the application and sign in section. American funds simple ira to establish your plan 1. Learn about the benefits, eligibility, pricing and plan administration. Use this single sheet to provide an overview of the simple ira plus plan setup and enrollment process. Go over the pros and cons of each type of ira; The simple ira plan — the savings incentive match plan for employees of. The amount you contribute to your simple ira is deducted from your salary before most federal. Review the it is easy to. Offer lower costseasy plan designimmediate vestingtax benefits Simple ira simple ira plus • an individual relationship with each plan participant. The benefits of the plan. Review the understand your simple ira options brochure. An ira participant is allowed only one rollover from one ira to another (or the same ira) across all iras (traditional, rollover, roth,. Use this single sheet to provide an overview of the simple ira plus plan setup and enrollment process. Now it is easier for you to keep that focus because your employer has started an mfs® simple ira plan. This brochure is designed to help financial professionals and retirement plan sponsors understand the requirements and timing of moving simple ira plans. When you set up your simple ira account, you have the opportunity to invest in the american funds, a family of mutual funds that has been helping people like you meet their savings goals. And you pay no taxes until you withdraw the money at retirement. Explain the ira conversion opportunity ;. Digital investing programretirement calculatorfund comparison toolinvestment tools With the premiere select simple ira plan, you can reduce your current income taxes. To learn more about setting up a self directed simple ira and exploring its benefits, visit american ira.Bring Retirement in Focus

Simple Gold IRA One Sheeter Firebrand Design & Business Solutions

The Benefits of Investing in a SelfDirected Roth IRA American IRA

Keep Your Retirement Savings on Track. ppt download

What makes American Funds’ SIMPLE IRA Plus different? YouTube

How to move a SIMPLE IRA to an American Funds SIMPLE IRA Plus YouTube

American Funds SIMPLE IRA Plus Employee Enrollment Guide

(PDF) SEP IRA American Funds · both American Funds and your home

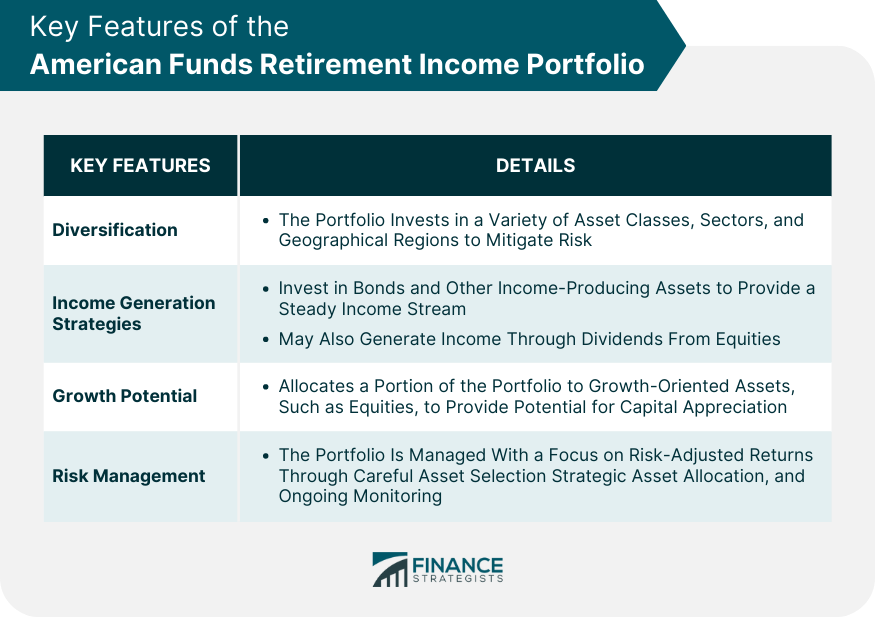

American Funds Retirement Portfolio Features, Costs

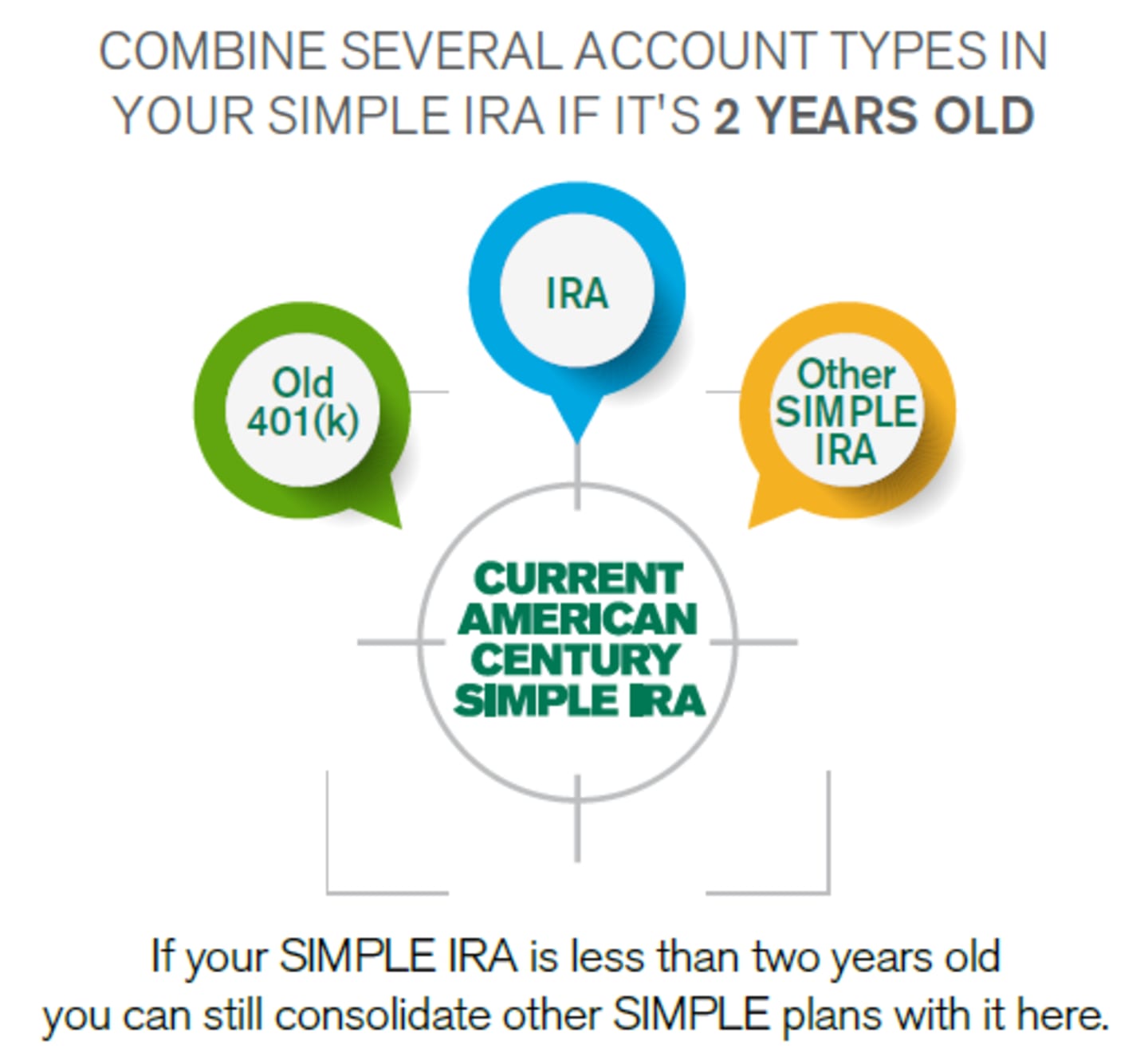

SIMPLE IRA American Century Investments

An American Funds Simple Ira, Your Employees Can Participate In A Quality Retirement Plan That’s Similar To A 401(K) But Designed Especially For Small Businesses.

Compare The Benefits And Key Features Of Simple Ira And Simple Ira Plus Plans To Determine Which Option Is Best For Your Client.

Trusted By Millionssee Our Comparison Table2020'S 5 Bestus Dealers

To Open Your Simple Ira, Complete The Application And Sign In Section 7.

Related Post: